| |

|

| |

Young

adults

in Metro

Detroit

own

homes

and save

more

than

nationwide

peers,

but most

still

don’t

feel

“Life

Ready”

Bank

of

America/USA

TODAY

Better

Money

Habits

Report

Shows

Economic

Issues

Top

Social

Issues

As Young

Voters

Head to

Polls

DETROIT

– A

newly

released

Bank of

America/USA

TODAY

Better

Money

Habits®

report

finds

that for

18- to

26-year-olds

in metro

Detroit,

the

definition

of

adulthood

has

changed:

it is

less

about

age and

more

about

financial

independence.

In fact,

the

majority

(60

percent)

did not

feel

like

adults

when

they

turned

18.

When

asked to

define

adulthood,

this age

group,

which

includes

the

youngest

millennials

as well

as the

oldest

members

of

Generation

Z,

responded

“working

or

having a

full

time

job” as

the top

answer.

Additionally:

•

Roughly

one in

three

(34

percent)

define

adulthood

as

having

achieved

a

financial

milestone

such as

buying a

house or

car,

compared

to

having

achieved

traditional

life

milestones,

such as

getting

married/starting

a family

(8

percent)

or

graduating

from

high

school/college

(7

percent).

• For

those

who feel

like

adults,

the

majority

(62

percent)

say it’s

because

parents

helped

prepare

them.

For

those

who do

not feel

like

adults,

almost

half say

it’s

because

they

still

rely on

their

parents.

In fact,

many

still

rely on

others

to help

with

financial

responsibilities:

only 30

percent

of young

adults

do their

own

taxes

and just

over

half (51

percent)

pay

their

own cell

phone

bills.

At the

same

time, 63

percent

say they

are

setting

aside

money as

savings

and 27

percent

are

contributing

to a

401(k).

Also of

note:

nearly

one in

five (18

percent)

own a

home – a

figure

that is

11

percentage

points

higher

than the

national

average.

“The

fact

that so

many

young

adults

are in a

place

where

they can

buy

homes is

impressive,

and it’s

great to

see that

so many

are

saving,”

said

Carol

Guyton,

market

sales

manager,

Bank of

America.

“This

shows a

degree

of

financial

responsibility

that not

all

young

people

possess.

At the

same

time, it

is

important

that

they

strike

the

right

balances

between

managing

short-term

costs

while

investing

in the

future.”

The need

for

additional

support

and

resources

is what

inspired

Bank of

America

to

partner

with

Khan

Academy

to

create

Better

Money

Habits,

a free

educational

resource

aimed at

empowering

people

to be

more

confident

in their

financial

decision

making.

The site

delivers

easy-to-understand

information

on a

wide

range of

personal

finance

topics

from

retirement

and

taxes to

buying a

home.

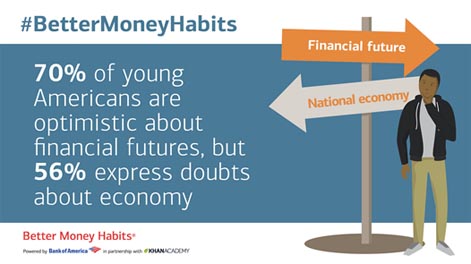

Majority

are

cautiously

optimistic

about

their

finances

While

nearly

three-quarters

(73

percent)

of young

adults

in metro

Detroit

feel

somewhat

or very

optimistic

about

their

financial

prospects,

they

cite the

economy

(60

percent)

and job

market

(41

percent)

as poor.

Additionally,

a

majority

(71

percent)

report

being

worried

about

finding

a career

path

that

will

support

the

lifestyle

they’ve

envisioned

for

themselves

– 12

percentage

points

higher

than the

national

average.

Majority

wish

they

learned

more

about

personal

finance

in

school

While

striving

for

financial

independence,

young

adults

in metro

Detroit

say they

did not

learn

enough

about

practical

money

matters

in

school.

Though

their

education

has set

them up

for

success

in other

ways,

young

Detroit-area

residents

are not

necessarily

feeling

“life

ready”

upon

graduating.

Only 40

percent

said

their

high

school

education

did a

good job

teaching

them

strong

financial

habits.

When

asked

what

they

wish

they had

learned

more

about in

school,

nearly

all

named

topics

related

to

personal

finance,

more so

than any

other

life-readiness

skill:

•

Forty-six

percent

wish

they had

learned

how to

do

taxes.

•

Forty-one

percent

wish

they had

learned

how to

invest.

•

Thirty-five

percent

wish

they had

learned

how to

manage

student

loans.

A lack

of

practical

knowledge

has left

some

graduates

feeling

less

than

prepared

for the

road

ahead.

Of those

who

attended

or are

attending

college,

40

percent

had

doubts

about

whether

it

prepared

or is

preparing

them for

the

“real

world.”

Pragmatism

at the

polls:

young

voters

prioritizing

pocketbook

issues

With the

campaigns

in the

home

stretch,

the

report

also

surveyed

young,

first-

and

second-time

voters

in the

Detroit

area.

Contrary

to the

narrative

that

this age

group is

overly

idealistic,

young

voters

in the

area are

actually

quite

pragmatic:

the

majority

(65

percent)

said

that

economic

issues

are more

important

to them

than

social

issues

(34

percent)

in how

they

vote.

Additionally,

79

percent

of those

with

student

debt say

it will

impact

the way

they

vote.

While

concerned

about

their

pocketbooks,

if

forced

to

choose

between

two

candidates

– one

who is

best for

their

personal

finances

and one

who is

best for

the

country

– the

majority

(83

percent)

would

prioritize

what’s

best for

the

country.

|

| |

|

|

|

|

|